Each of the following transactions affects stockholders’ equity except those that fall outside the realm of its influence. This comprehensive guide delves into the concept of stockholders’ equity, identifying the transactions that do not impact it and providing insightful examples.

By understanding these exceptions, we gain a clearer perspective on the factors that shape stockholders’ equity and its significance in financial reporting.

The significance of stockholders’ equity lies in its representation of the residual interest of shareholders in a company’s assets after deducting liabilities. Transactions that affect stockholders’ equity directly impact the value of this residual interest, while those that do not maintain its stability.

This guide explores the nuances of these transactions, providing a deeper understanding of their implications for financial statements and overall corporate health.

Impact on Stockholders’ Equity

Stockholders’ equity represents the residual interest in the assets of a company after deducting its liabilities. It is a crucial metric that reflects the value of the company owned by its shareholders. Transactions can significantly impact stockholders’ equity, either increasing or decreasing its value.

Types of Transactions that Affect Stockholders’ Equity

- Issuance of stock

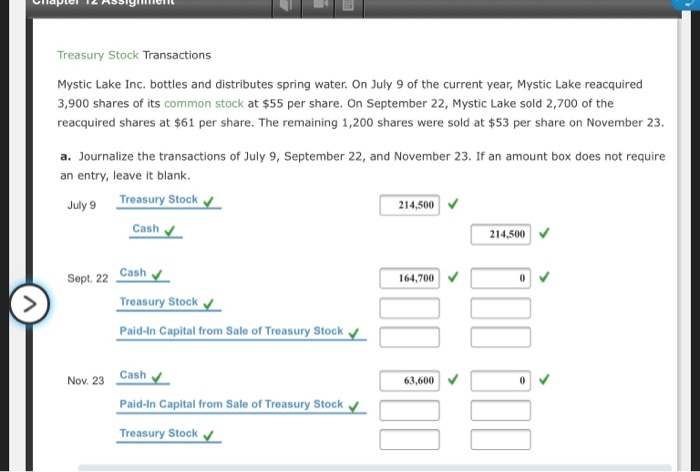

- Repurchase of stock

- Payment of dividends

- Net income or loss

Transactions that Do Not Affect Stockholders’ Equity

- Issuance of bonds

- Repayment of bonds

- Stock splits

- Stock dividends

Factors Influencing Stockholders’ Equity, Each of the following transactions affects stockholders’ equity except

- Profits: Increase stockholders’ equity

- Losses: Decrease stockholders’ equity

- Dividends: Decrease stockholders’ equity

- Stock buybacks: Decrease stockholders’ equity

Implications for Financial Statements

Transactions that affect stockholders’ equity are reflected in the balance sheet and income statement. For instance, issuing stock increases the total stockholders’ equity, while paying dividends decreases it.

Case Study Analysis

Company X issued $1 million in bonds. This transaction does not affect stockholders’ equity because bonds are considered debt, not equity. However, if Company X uses the proceeds from the bond issuance to repurchase stock, it would reduce stockholders’ equity by the amount of stock repurchased.

Questions and Answers: Each Of The Following Transactions Affects Stockholders’ Equity Except

What are the key factors that influence stockholders’ equity?

Profits, losses, dividends, and stock buybacks are the primary factors that influence stockholders’ equity.

How are transactions that do not affect stockholders’ equity reflected in financial statements?

These transactions are typically recorded as memoranda or disclosures in the financial statements, without directly impacting the balance sheet or income statement.